The pain to come

The policy debate is focussed on this winter. But 2023 as a whole needs more attention.

This morning, I checked the BBC weather app and learned that the temperature this afternoon would be only 25°. Four or five weeks ago I would have regarded that as a very hot day indeed. But by contrast with the extremes of the heatwave, it seems almost refreshingly cool. It’s amazing how quickly we anchor on recent experiences.

I worry that something similar is happening in the (non-monetary) policy discussions around inflation.

This winter is going to be dreadful. NIESR, not a think tank known for their hyperbole, today warn that millions of people facing hitting the breadline.

The National Institute of Economic and Social Research (NIESR) said Britain was sliding into a recession that will hammer the most deprived areas of the country and force more than a million households to choose between heating their homes and purchasing sufficient food.

The public are well aware of the pain coming down the tracks when the energy price cap rises again. And so to is the political discussion.

But, judging from the tone of that debate and the kind of policy interventions being banded around, I’m worried that there is too much focus on the coming winter and not enough on 2023 as a whole.

The latest consensus forecast, according to the Treasury’s compilation of independent forecasters, is for CPI to average 4.7% in the final quarter of 2023.

Today 4.7% sounds like a low number – certainly when put against the kind of numbers expected in the coming months. But 4.7% is an uncomfortably high number when set alongside the OBR’s forecast of average nominal earnings growth of 2.8%.

As some excellent analysis from the Resolution Foundation this morning notes, even that 4.7% should be taken with a pinch a salt. As the Foundation explain, recent moves in gas prices suggest that the peak in inflation may come later than the Bank currently expect, that may last for longer and that it may be at a higher level. 15% is not an implausible number.

Some pretty heroic assumptions are needed to see inflation falling rapidly.

But whatever the rate of inflation is in 2023, the level of prices looks set to remain high.

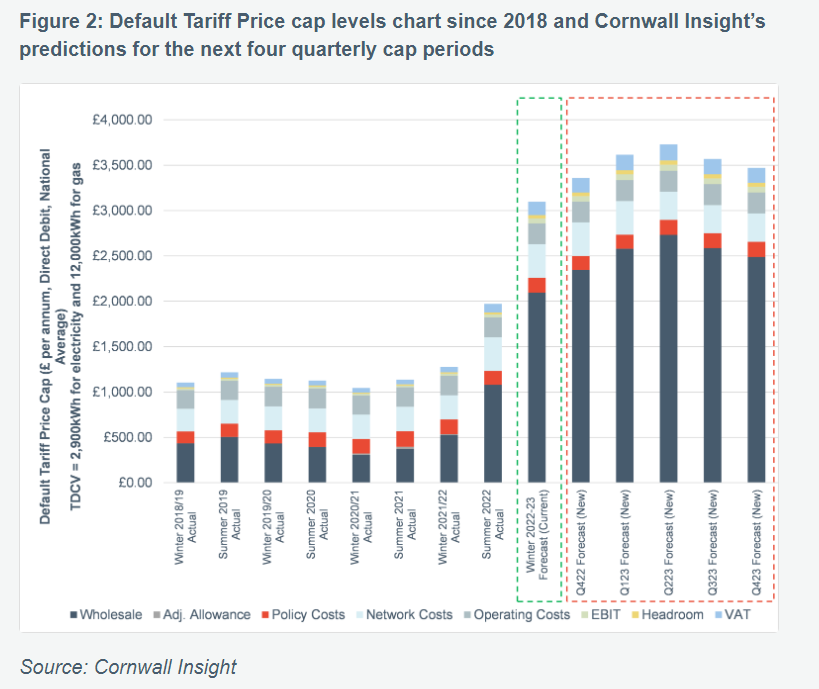

The latest (horrifying) forecasts for energy bills from Cornwall Insight rams the point home.

The rate of change in bills drops markedly over the course of 2023, compared to 2022, but the absolute level of bills remains terrifyingly high.

The difficulties experienced by households – and firms – won’t stop even as the headline rate of inflation diminishes. The level of energy bills matters just as much as the rate of change.

As Cornwall note, the package of measures announced this Spring already look inadequate.

While the government has pledged some support for October’s energy rise, our cap forecast has increased by over £500 since the funding was proposed, and the truth is the £400 pledged will only scratch the surface of this problem…

Our new figures show that even increasing support for October will not make much of a dent in what is likely to be a sustained period of high energy bills. A review of delivering support for the next cap periods should be on the top of the to-do-list for any incoming Prime Minister. As our price cap breakdowns show, tinkering with VAT and policy costs will only make a dent in bills, when it is the high wholesale prices behind the increases.

And, as I noted when the measures were announced back in May, the implicit assumption behind the entire package was that energy prices would falling in 2023.

What happens next year?

This is the really big unanswered question. Implicit to the entire package is a belief that energy prices will fall in 2023. The government is extending extraordinary support to help households cope with, what is hopefully, a temporary period of high global energy prices.

But it is worth asking: what if prices stay high in 2023? Will the package be left in place? This is the kind of thing HMT civil servants will be worrying about this evening.

That assumption looks increasingly forlorn. Britain’s new Prime Minister is not only going to have to beef up support for households this winter but roll forward some, or all, of that package into 2023. If price energy prices remain at these sorts of levels the entire debate on the timing of tax cuts which is dominating the Conservative leadership election feels irrelevant. The real issue will be avoiding whacking households when the planned support package comes to an end. That will prove expensive.

Thanks for reading Value Added. It is a subscriber funded publication. If you’re enjoying it please do consider taking out a subscription. You’ll get more posts and I’ll get the resources to carry on writing it.