Value Added Round-Up

The Treasury is still the Treasury. What worker bargaining power? Is the political business cycle broken?

It’s a busy week at Value Added with posts for subscribers due tomorrow and Friday. There is also a lot of news around. Too much news and most of it fairly grim. So, in the spirit of experimenting with formats, this is the first attempt at a Value Added round-up.

Omicrononomics Again. The Treasury is still being the Treasury.

Her Majesty’s Treasury is a frustrating institution. In moments of real crisis it is capable of moving with a speed and surety of foot that the rest of Whitehall cannot match. Pulling together the furlough scheme in a matter of days last Spring or leading the way globally in 2008 in showing the need to recapitalise banks rather than simply offering more liquidity support both come to mind. But outside of an acute crisis it is more often a brake on action rather than a driver. It is still a finance ministry first and foremost and an economics ministry only when it must be. The institutional instinct is to resist more spending and that often leads the kind of penny-wise, pound-foolish attitudes that sees the government doing things like selling off its flagship vaccine centre. (If anyone wants a longer read on the 19th century roots of the Treasury attitude – which would make an excellent Christmas present – I can recommend one).

My own attitude to the Treasury swings wildly. Sometimes I would be content with creating a proper economics ministry and downgrading HMT to the role of finance ministry only and other days I think the building itself should be demolished and the earth around it salted.

Today I am leaning towards the latter. Omicron is spreading rapidly. The hospitality sector is seeing their best trading season of the year vanish to voluntary social distancing,

As with every wave of the virus so far, there is a temptation to see a trade-off between actions to support public health and the needs of the economy. And as with every wave of the virus so far that trade-off does not exist in the short-term. The pubs may still be open but the punters are not packing in, or at least not in their usual December volumes. Whatever the rules say, there are plenty of people who would rather not risk self-isolating at Christmas.

The (one) upside to Omicron spreading so rapidly is that this wave should be over quickly. The costs of 4-8 weeks of a mini-sectorally targeted furlough scheme, a high street business rates holiday and some targeted grants would not be especially large. The costs of not doing so will be larger.

So, about that rebirth of worker bargaining power?

CPI inflation came in ahead of expectations today at 5.1%. That was ahead of economist forecasts for November but really isn’t a huge surprise. The talk has been of “inflation above 5% by Autumn” for quite a while now.

Yes, it is the highest in a decade but there a few points worth keeping in mind. As Samuel Tombs notes, the Bank of England’s usual preferred tracker of domestically generated services inflation is less elevated.

The big story is one of rising global energy prices and global production chain snarl-ups both of which should be, to use a word one hears a bit less nowadays, transitory.

More interesting, I think, is to note that prices are now clearly rising faster than wages. Yesterday’s labour market stats put average real weekly earnings in 2015 prices at £520 in October. In January they stood at £519. Don’t rush out and spend it all at once.

For all the talk of a new age of worker bargaining power, a real wage squeeze seems much more likely in the coming months than rising real terms pay.

Next week I am going to write about the mechanics of wage bargaining in Britain. But the really short version is that the pandemic may have caused an upward level shift in some sectors, but it hasn’t changed the structural picture.

My pessimism on the picture for pay at least has the silver lining of keeping me optimistic on the inflation outlook.

The pandemic broke the business cycle. Has it also broken the political-business cycle?

British politics is getting interesting again. Labour have taken a consistent lead in recent polls.

The usual comment offered by those seeking to sound sage at this point is to note that one should expect oppositions to be leading the polls in a government’s mid-term period and then to swing back in the government’s direction as an election draws near.

The problem with this received wisdom is that that pattern hasn’t fitted the UK data for at least a decade.

But more generally, a reoccurring theme of this newsletter has been that the pandemic knocked the economy off the usual business cycle. That idea can be extended to the political business cycle too.

The usual pattern of British fiscal policy has been to tighten after a general election victory and then to loosen as the election nears. Rishi Sunak’s latest set of fiscal projections certainly seem to build in room for such a loosening and he is keen to talk up his tax cutting beliefs (even whilst taking the tax take to its highest levels in decades).

But whatever his intentions, the pandemic does seem to have rather gotten in the way. The need to respond to the shock meant a dramatic loosening of policy less than six months after the December 2010 election.

That is now being reversed. Taxes on employers and employees are set to rise in April. Corporation tax is now on a steep escalator. The level shift in some wage packets has not been met by an adjustment in tax thresholds and so more people will experience higher tax bills through fiscal drag.

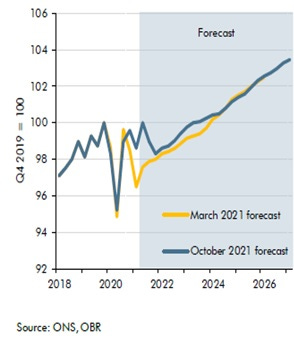

It is hard to see the usual pre-election feel good factor in the Office for Budget Responsibility’s forecast of disposable income. On their numbers real household disposable income per head (i.e. after price rises and tax and benefit changes) will be just 1.1% higher than in December 2019 by the end of 2024.

I have no idea whether Labour’s poll lead will last or not. But there are plenty of reasons to think that the mechanisms which usually see the government’s polling numbers improve as an election nears may not be operating.

If you’re enjoying Value Added – please do consider subscribing. You’ll get more posts and I’ll get the resources to carry on producing it.