Omicronomics Update

The real time data already shows lower mobility and weaker spending on consumer services.

At the end of November, as the early spread of Omicron prompted a mild tightening of the government’s Covid rules for England, I wrote that those restrictions were unlikely to have a material impact on the economy but that, whatever the official rules, household behaviour could easily begin to shift to minimise contacts and reduce spending on services.

Yesterday government regulations were tightened further with those who can work from home urged to do so from next week1.

Ten or so days on from the first tightening of the regulations, the real time data is beginning to point to signs of some increased distancing, weaker services spending and decreased mobility – before the “official” return of increased home working.

The Department for Transport’s tracking of mobility is available until Monday the 6th of December. A look back over the last few Mondays shows a reasonably steep drop in national rail usage over the past two weeks, a small fall in other types of public transport transit and broadly flat driving levels.

Given the demographics of rail commuters, that seems consistent with a pick-up in working from home over the last couple of weeks from some city centre office workers. In other words some of those most able to work from home have likely already resumed doing so.

More broadly, the ONS also note today, that seated diners in restaurants – according to OpenTable – fell by 6 percentage points in the week to December 6th – to their lowest weekly level since May this year.

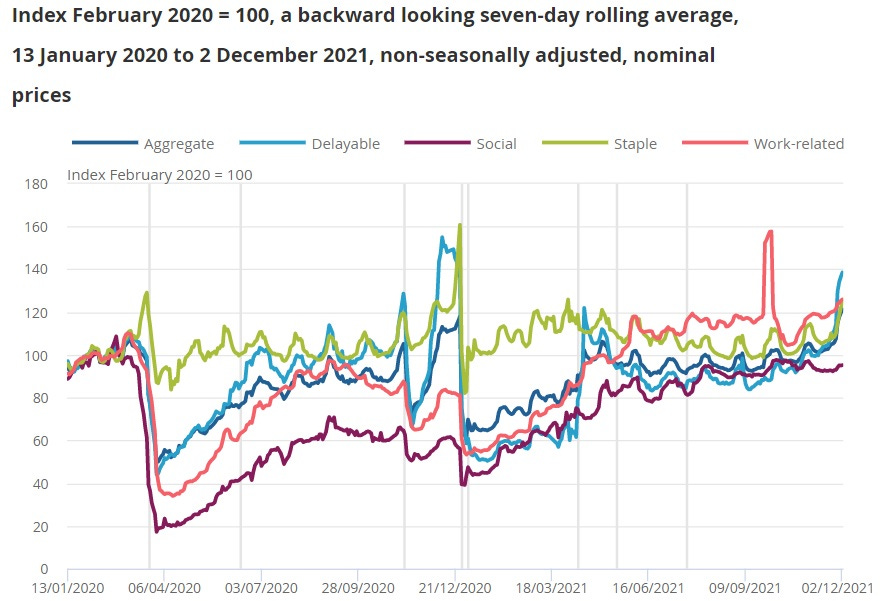

The CHAPs data on debit and credit card spending is somewhat distorted by Black Friday. Indeed, spending levels over the last week have been at their highest level since the beginning of the pandemic driven by increased purchases of “delayable” and “staple” goods.

Zooming in on just the social spending category since the start of October presents a worrying picture for British hospitality firms. The non-seasonally adjusted series shows daily spending levels below early October levels at the beginning of December – traditionally the strongest month for the sector. Cancelled Christmas parties and lower levels of commuting look set to add to the pressure.

Assuming no further tightening of the regulations, something in the region of a 0.5% of GDP hit to growth over December and January now seems likely with much of the pain being concentrated on the hospitality and transport sectors and geographically in city centres.

Monetary policymakers had been hoping that a shift back in consumer spending away from goods and towards services would prove disinflationary but such a shift is now likely on hold for a few weeks at least. If anything, goods are likely to take up a bigger proportion of household spending over the coming few weeks and put a small amount of upwards pressure on the inflation numbers.

But over a longer time horizon, weaker activity over the winter could well take some of the tightness out of the jobs market. It’s hard to image the help wanted signs staying in so many café windows for much longer.

The Omicron wave presents something of a challenge for macro-policy in Britain. Expectations of a rate hike in December – which always felt a touch far fetched after the tone of the messaging in November – are receding. And it is worth taking a moment to imagine just how ridiculous the Bank would have looked if it had hiked in November and then found itself under pressure to cut again this month or in February.

The Treasury are keen to hold the line on no additional fiscal support for firms and households at present.

So, in contrast to previous waves of the pandemic, the macro-policy stance is currently to simply take this hit on the chin. That position will hold unless further restrictions involve actually ordering hospitality venues to close to indoor trade, in those circumstances it is hard to not see the return of a scaled down, sectorally targeted, furlough type scheme and some form of tax breaks or direct grants for effected firms.

Just a month or so ago the outlook appeared much brighter - the labour market handled the end of the furlough scheme exceptionally well. But in a pandemic-driven business cycle, what happens with the virus is still the dominant factor. The last few weeks have been an unpleasant reminder that the pandemic isn’t over yet.

If you’re enjoying Value Added please do subscribe. You’ll get more posts and I’ll get the resources to carry on producing it.

Alongside this the rules on isolation for contact with an Omicron cases were slightly loosened from 10 days of isolation to 10 days of testing. That should have small but positive impact on labour supply in the weeks ahead.